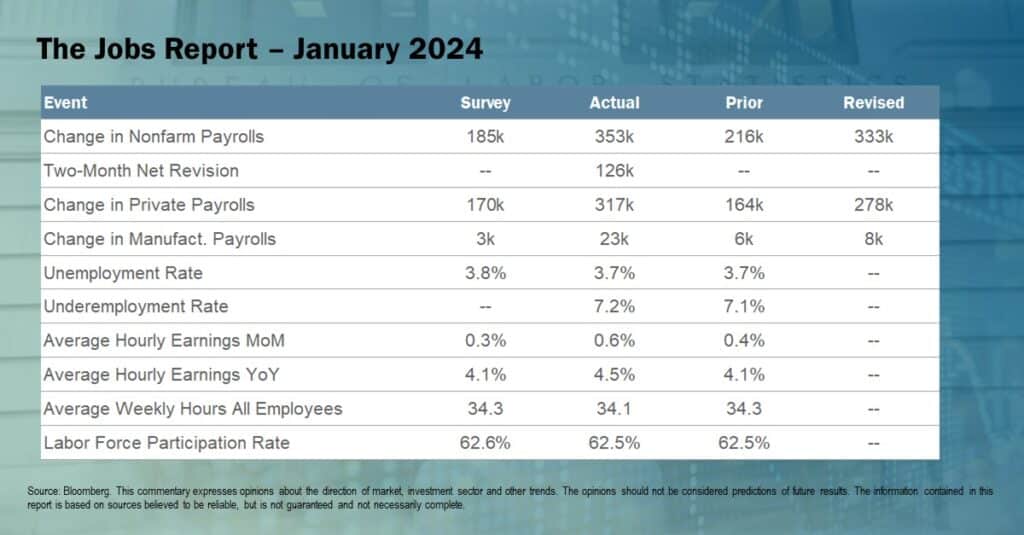

During January the economy added 353K jobs, much stronger than the expected gain of 185K. December and November gains were revised higher to 333K and 182K, adding an additional 126K jobs for the last two months of 2023. The revisions for most of the past year have been downward, so the large December revision is noteworthy. For the year the total downward revisions were 317K.

Below is a link to the full statistical summary provided by the Bureau of Labor Statistics:*

http://www.bls.gov/news.release/empsit.b.htm

*The information contained herein has been prepared from sources believed to be reliable but is not guaranteed and is not a complete summary or statement of all available data nor is it considered an offer to buy or sell any securities referred to herein. Links included herein are to unaffiliated third party sites. The Firm cannot verify or guarantee the accuracy of any information presented therein. By clicking on these links, the reader understands and acknowledges they are leaving Ziegler Capital Management’s web page.